The recent suggestion of an inheritance tax by Sam Pitroda, advisor to Rahul Gandhi and the Congress party, reignited debates over Congress’s historical stance on the issue. The proposal sparked controversy reminiscent of Pitroda’s previous “Hua to hua” remark, leading to widespread condemnation and subsequent distancing by Congress leaders.

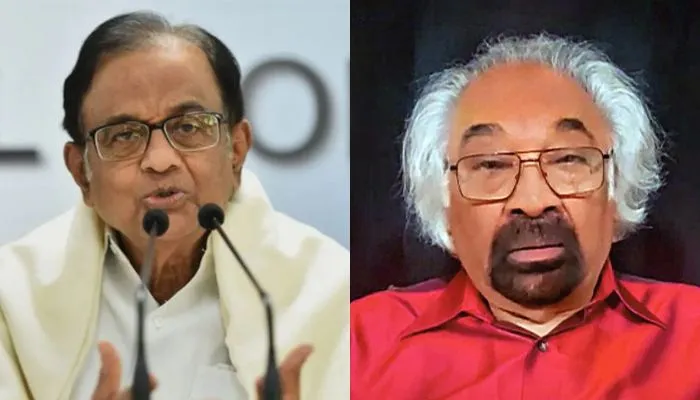

Although Congress officials denied any current plans for an inheritance tax, it’s noteworthy that previous Congress governments had implemented such a tax, known as estate duty, for over three decades. Even as recently as March 2023, senior Congress leader P Chidambaram had advocated for its reintroduction.

Historical Context: Estate Duty

The Estate Duty Act, introduced in 1953, aimed to address economic inequality by taxing assets transferred to legal heirs upon the property owner’s death. However, the tax system faced criticism for its complexity and high rates, reaching up to 85% for estates valued over Rs 20 lakh.

Despite its progressive intent, the estate duty law was abolished in 1985 under the Rajiv Gandhi government, amidst concerns that it failed to achieve its goal of reducing wealth disparity. This decision came just before the transfer of Indira Gandhi’s estate, further highlighting the political context surrounding the tax’s repeal.

Potential Reintroduction Under UPA Government

Media reports from the UPA era indicate a willingness to reconsider an inheritance tax. Figures like P Chidambaram reportedly advocated for its reintroduction, citing the need to raise tax revenue and address wealth inequality. However, concrete action on this front did not materialize during the UPA’s tenure.

Chidambaram’s continued advocacy for an inheritance tax post-2014 underscores Congress’s enduring interest in the issue. Despite facing criticism for its complex implementation and limited revenue generation in the past, the idea remains part of the party’s economic discourse.

Current Debate and Political Implications

The recent controversy surrounding Sam Pitroda’s suggestion reflects broader ideological divisions between parties on economic policy. While Congress may distance itself from specific proposals, its historical support for an inheritance tax underscores its commitment to addressing wealth inequality through progressive taxation.

As India grapples with economic challenges and debates over tax policy intensify, the legacy of the estate duty and the potential for its revival continue to shape political discourse. Whether Congress will pursue concrete action on this front remains uncertain, but its historical stance suggests that the issue will remain relevant in future policy debates.

Discover more from The Doon Mozaic

Subscribe to get the latest posts sent to your email.

One thought on “Congress’s History with Inheritance Tax”